Best Document Management System: Top 10 DMS Providers

A DMS for insurance brokers reduces document search time, improves efficiency, and manages policies, claims, and compliance securely.

Claims delays are one of the top reasons clients switch insurance providers. After all, insurance professionals can spend up to 30% of their workday searching for documents.

When claims and consultations start to pile up, this becomes a real issue.

When documents are scattered across emails, folders, and filing cabinets, resolution times suffer.

A DMS for insurance companies centralizes claims documentation and speeds up response times to improve client trust.

A document management system is a software designed to capture, store, organize, and retrieve documents throughout their entire lifecylce.

For insurance brokers, these documents could include policy documents, applications, claims files, client communications, compliance records, and third-party correspondence. When you’re handling many clients, different types of documents can stack up and wreak havoc on your efficiency and your reputation.

Insurance brokers handle large amounts of documents in a and highly regulated environment.

Every client interaction generates paperwork, from quotes and binders to endorsements, renewals, and claims documentation. A DMS brings structure to this complexity by replacing paper files, email attachments, and shared drives with a centralized, searchable, and secure system.

This ensures that critical information is always accessible, accurate, and up to date.

Beyond simple storage, a modern DMS adds value by automating workflows, enforcing compliance, and improving collaboration.

For insurance agencies, this translates into faster response times, reduced operational risk, improved customer experience, and the ability to scale without increasing administrative overhead.

Insurance agencies that rely on manual or fragmented document processes face significant operational and regulatory risks.

Lost or outdated documents can delay claims processing, lead to coverage disputes, or result in compliance violations. In an industry where accuracy and timeliness directly impact trust, these issues can damage client relationships and expose agencies to legal and financial consequences.

A DMS reduces these risks by establishing a single source of truth for all insurance documentation.

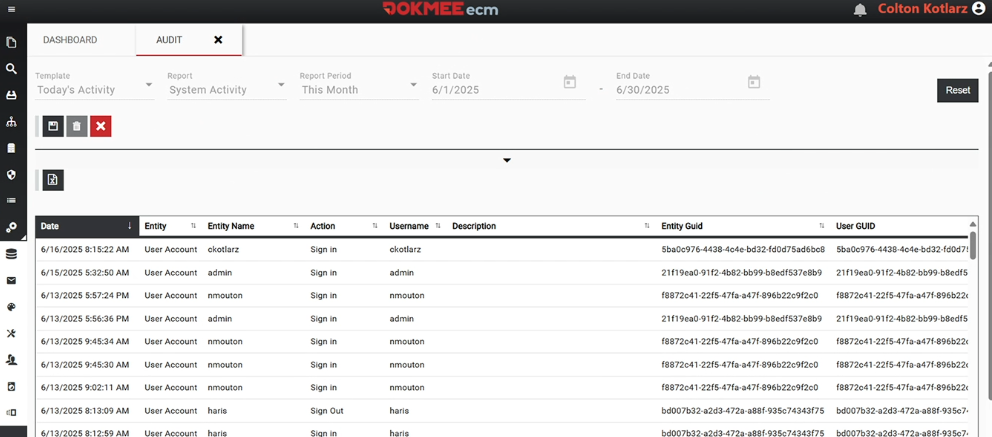

Version control ensures that brokers and support staff always work with the most current policy information, while audit trails provide clear visibility into who accessed or modified documents. This level of traceability is critical during regulatory reviews, internal audits, or legal disputes.

From a business perspective, the benefits are equally compelling.

A DMS significantly reduces the time staff spend searching for files, managing emails, or recreating lost documents.

Automated workflows streamline approvals, renewals, and claims processes, allowing brokers to focus more on advisory services and client acquisition. Improved security through role-based access and encryption also protects sensitive personal and financial data, helping agencies meet data protection and privacy requirements.

Without a DMS, agencies often struggle to scale.

As client volumes grow, document chaos increases, errors become more frequent, and service quality declines. Implementing a DMS enables sustainable growth by creating standardized, efficient, and compliant document processes.

A DMS platform supports insurance operations across the entire policy lifecycle.

To show you how you could apply a DMS to your day, here are five real-world scenarios that illustrate how insurance agencies use DMS and ECM features in practice.

When a new client is onboarded, brokers collect applications, identification documents, risk assessments, and underwriting information.

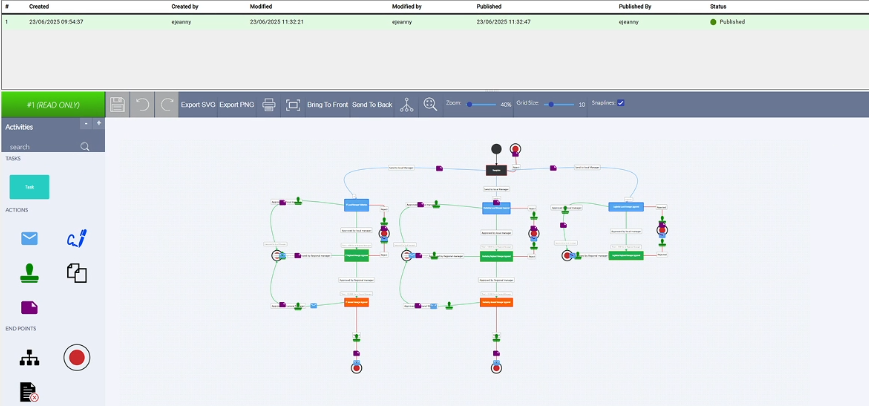

A DMS captures these documents digitally, indexes them using metadata such as client name, policy type, and effective date, and routes them through automated approval workflows.

This ensures faster policy issuance while maintaining a complete and compliant client record.

Renewals generate significant administrative work and are often time-sensitive.

A DMS uses automated workflows and notifications to alert brokers of upcoming renewals and required documentation.

Version control ensures endorsements and policy changes are accurately tracked, while document retention rules maintain historical records for compliance and reference.

During claims processing, agencies must manage loss reports, adjuster notes, photos, correspondence, and settlement documents.

A DMS centralizes all claim-related files and links them to the client and policy record. Secure file sharing allows collaboration with carriers, adjusters, and legal teams, while audit logs provide transparency throughout the claims lifecycle.

Additionally, both clients and workers can sign all documents or add annotations directly from the software, so no document is left unnoticed.

Insurance regulators require agencies to retain records for defined periods and demonstrate proper handling of client data.

A DMS enforces retention schedules automatically, ensuring documents are archived or disposed of according to regulations. Complete audit trails and access logs simplify regulatory audits and reduce compliance risk.

Modern insurance agencies often operate across multiple locations or support remote work.

A DMS enables secure collaboration by allowing authorized staff to access documents from anywhere. Features such as role-based access, mobile applications, and Microsoft Office integration ensure productivity without compromising security.

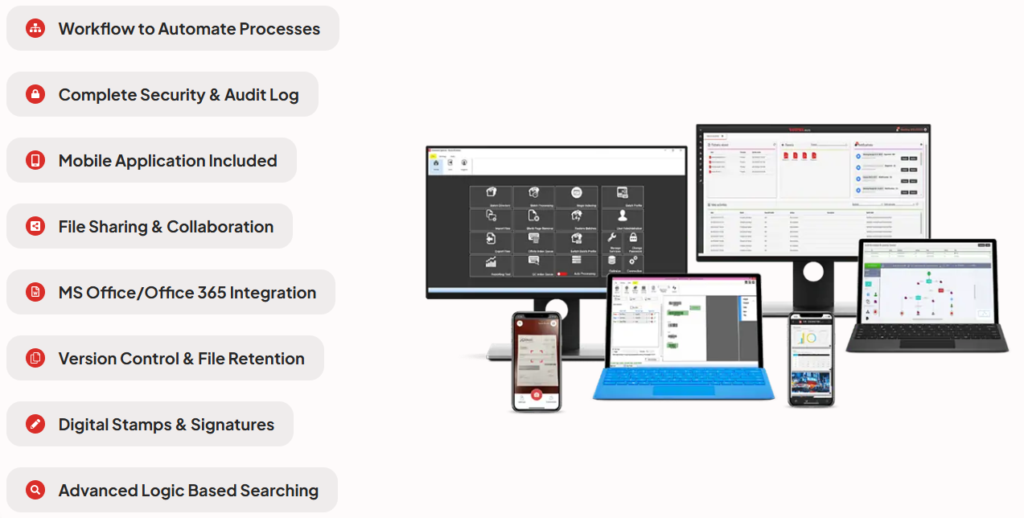

Dokmee is an enterprise-grade DMS and ECM platform solution built to meet the specific needs of insurance brokers and agencies. It combines powerful document organization with automation, security, and compliance-focused features.

You can also include products such as electronic form builder or advanced document capture.

Dokmee allows insurance firms to centralize all client and policy documents within secure digital file cabinets enhanced by advanced metadata indexing and logic-based search.

Automated workflows streamline policy approvals, renewals, and claims processes, while full audit trails and role-based security controls support regulatory compliance and data protection requirements.

With mobile access, seamless Microsoft Office integration, digital signatures, and configurable retention policies, Dokmee supports both day-to-day operations and long-term growth.

Insurance agencies gain faster processes, reduced risk, and complete visibility over their information assets.

If you’re ready to try, book your free Dokmee demo today to see how secure, scalable document management can transform your insurance operations.

Schedule Your Free Demo—Anytime, Anywhere

Experience enterprise-grade ECM with zero hidden fees and instant ROI:

“Dokmee cut our retrieval time by 70%—we saw ROI in 45 days.”

Chad P., CTO