Automated Document Indexing: How to Find Any File in Seconds

What happens when you’re faced with a sudden lawsuit or tax audit?

The first request is always for documents. If your records are a disorganized mess, or worse, were deleted prematurely, you’re opening the door to legal penalties.

Without a clear plan, businesses tend to do one of two things: keep everything forever, which drives up storage costs and creates a massive liability, or delete things haphazardly, risking non-compliance. Both are losing strategies.

A document retention policy is the official roadmap that solves this.

It’s a simple set of rules that tells your organization exactly what to keep, how long to keep it, and when to dispose of it securely. It’s a foundational part of your business’s risk management strategy.

A document retention policy is a formal, written set of guidelines that governs how your company manages and disposes of its records.

It helps organizations stay on the right side of regulations like HIPAA and SOX, reduces the risk of legal headaches if lawsuits arise, and streamlines daily operations by cutting out unnecessary information.

A formal policy is a shield for your business that transforms your document management from a liability into a well-managed asset.

How does it protect you?

| The Risk of Inaction | The Business Consequences |

|---|---|

| Legal and Compliance Penalties | You risk major fines for not producing required documents during an audit or lawsuit. |

| High Storage Costs | Keeping every document forever leads to increasing physical and digital storage expenses. |

| Inefficient Information Discovery | Your team wastes countless hours and money trying to find a specific document when your files are unorganized. |

| Data Breach Vulnerability | Storing old, sensitive data you no longer need increases your potential attack surface and liability. |

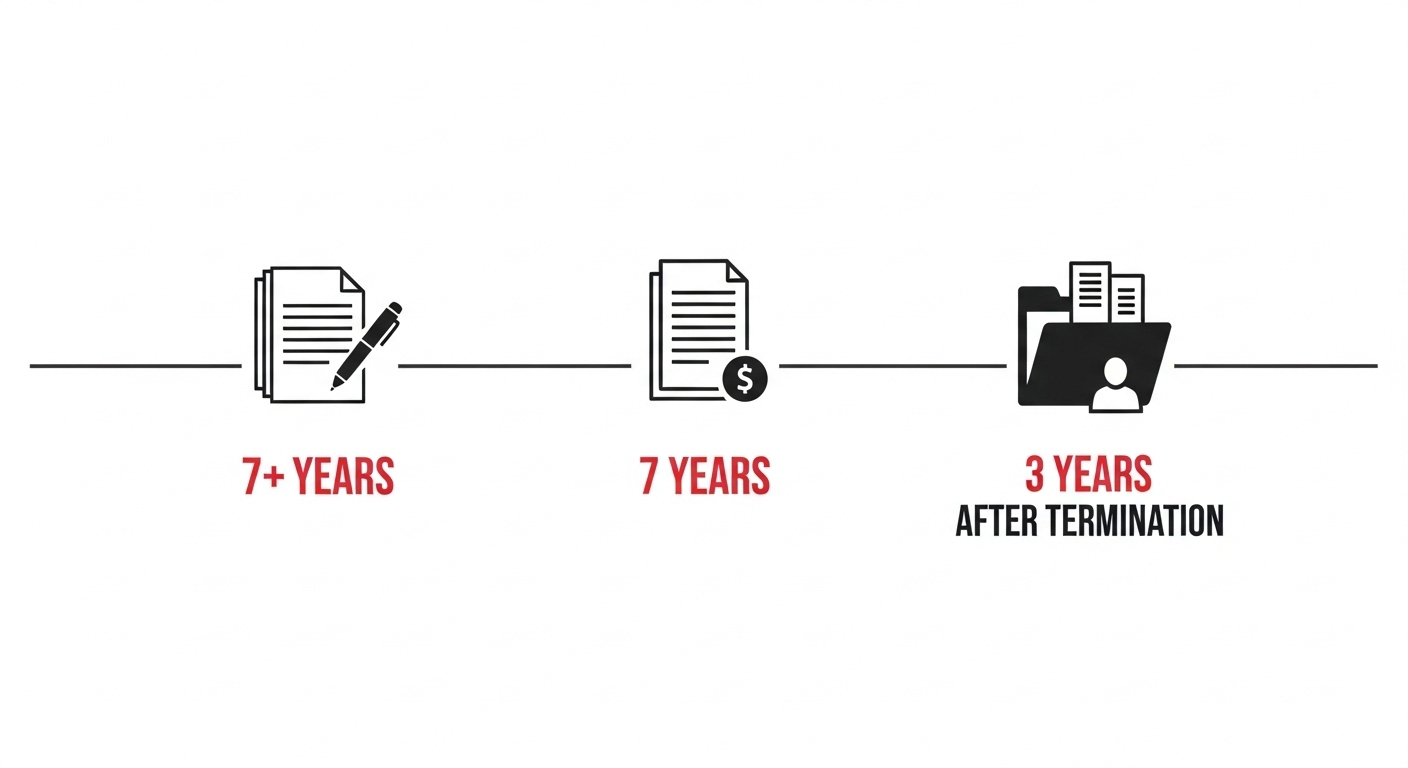

Retention periods vary by document type and are governed by different regulations.

While you should always consult with a legal professional, here’s a general guide based on common requirements.

| Document Category | Examples | General Retention Period |

|---|---|---|

| Corporate Records | Articles of incorporation, bylaws, board minutes | Permanent |

| Accounting and Tax | Financial statements, tax returns, invoices | 7 years to permanent |

| Employee Records | Personnel files, payroll records, I-9 forms | 3–7 years after termination |

| Legal and contracts | Client contracts, leases, vendor agreements | Life of agreement + 7 years |

| Healthcare (HIPAA) | Patient records, PHI disclosures, authorization forms | Minimum of 6 years |

The retention periods in the schedule aren’t arbitrary.

They’re decreed by specific federal and state laws. Understanding who sets these rules helps clarify why compliance is so important.

Approach creating a retention policy systematically to make it durable and defensible. Think of it less as writing a single document and more as a four-phase project that involves your entire organization.

Never create a retention policy in a silo, otherwise it’ll be doomed to fail.

This isn’t an IT or a legal task. It requires a solid team who can provide a complete picture of the organization’s needs.

You can’t create rules for documents you don’t know you have. The goal of this phase is to create a complete inventory of all the information your company handles.

Go department by department and ask three simple questions for every type of document:

This audit forms the foundation of your retention schedule and gives you a clear map of your company’s information landscape.

This is where decision-making begins. Using the inventory from your audit, you’ll assign a specific retention period to every category of document.

Work with your compliance team to apply the relevant legal requirements to each document type.

When a document is subject to multiple regulations**, always apply the longest required retention period.**

If one law requires a file to be kept for three years and another says five, your policy should mandate five years.

This “err on the side of caution” is what keeps your policy defensible.

Once the rules are set, it’s time to formalize and implement them.

On paper, a policy is one thing. But enforcing it across an entire organization is completely different task.

Manual enforcement is nearly impossible and prone to human error. This is where an Enterprise Content Management (ECM) system like Dokmee steps in.

An ECM brings your retention policy to life by automating the entire process. The system can be configured with your retention rules, and it’ll automatically track the age of every document.

When a document file reaches the end of its required lifespan, the system can flag it for review or even securely delete it. It’ll also create a permanent audit trail of its disposal.

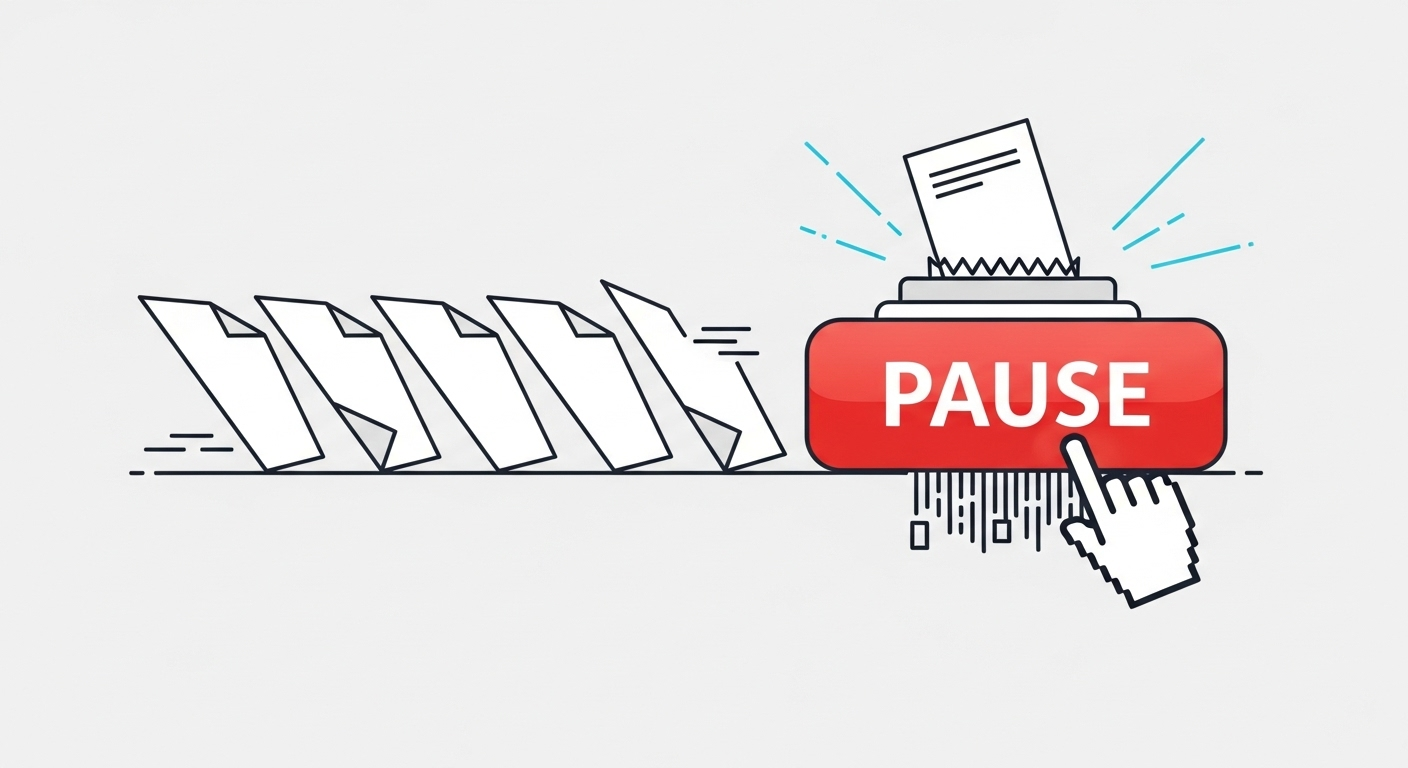

Further, if your company faces a lawsuit, you can apply a “litigation hold” with a single click. This instantly “freezes” all relevant documents, overriding their normal disposal date to make sure nothing is accidentally deleted.

Use this detailed, easy-to understand template as a starting point to build a policy that fits your business needs. Fill in the bracketed [blanks] with your own company’s information.

1. Purpose and Introduction

This policy establishes the guidelines for the management, retention, and secure disposal of company records for [Company Name].

The purpose is to meet legal and regulatory requirements, reduce operational risks, and preserve necessary company information while eliminating outdated data.

2. Scope

This policy applies to all employees, contractors, and departments of [Company Name].

It covers all company records, regardless of format, including but not limited to: electronic files (documents, spreadsheets, emails), scanned images, and physical paper documents.

3. Policy Administrator

The [e.g., Chief Compliance Officer or IT Director] is the designated Policy Administrator, responsible for the implementation, review, and enforcement of this policy.

4. Retention Schedule

All records must be retained for the minimum period outlined below. The retention period begins from the end of the fiscal year in which the record was created, unless otherwise noted.

| Document Category | Examples | Minimum Retention Period |

|---|---|---|

| Corporate Records | Articles of incorporation, bylaws, board minutes | Permanent |

| Finance and Tax | Audited financial statements, tax returns, general ledgers | 7 years |

| Invoices, expense reports, bank statements | 7 Years | |

| Human Resources | Personnel files, payroll records, I-9 forms | 7 years after termination |

| Job applications, resumes (for non-hires) | 3 years | |

| Legal and Contracts | Client and vendor contracts, leases, patents | Life of agreement + 7 years |

5. Secure Disposal Procedures

Once a record has met its minimum retention period, it must be disposed of in a secure and confidential manner.

A log of all disposed records must be maintained within our Document Management System.

6. Litigation Hold

Upon notification from the Legal Department of a pending or anticipated lawsuit, government investigation, or audit, the normal disposal procedures for any and all relevant records will be immediately suspended.

The Policy Administrator will implement a “litigation hold” within the ECM to freeze these records until the legal matter is formally resolved.

7. Annual Review

This policy will be reviewed annually by the Policy Administrator and the [e.g., Leadership Team] to ensure it remains compliant with current laws and regulations.

Policy Approval

Approved By: [Name, Title]

Date: [Date]

A document retention policy is just a plan until it’s put into action. Relying on employees to manually track and delete thousands of files is a recipe for failure.

Dokmee automates your policy, actively managing compliance, reducing your risk, and giving you peace of mind.

See how Dokmee can automate your retention policy

There’s no single “standard” period. It depends entirely on the type of document.

For example, the IRS generally requires financial records to be kept for 7 years, while employee records may only be needed for 3–7 years after termination.

Corporate records like articles of incorporation should be kept permanently.

A good policy will outline these specific timeframes by category.

A good retention policy is a clear, comprehensive, and easy-to-follow one.

It formally documents your retention schedule for all document types (both physical and digital), assigns a specific person to oversee it, and includes procedures for secure disposal and litigation holds.

A good policy is also actively enforced, ideally through an automated system.

A “record” is the final, official version of a document.

A draft of a contract that’s still being negotiated is a document. The final, signed version becomes a “record” and is subject to the formal retention rules outlined in your policy.

A litigation hold is a formal instruction from your legal team to immediately suspend the normal disposal procedures for any records that might be relevant to a lawsuit or government investigation. It’s a critical legal process that overrides your standard retention schedule.

Schedule Your Free Demo—Anytime, Anywhere

Experience enterprise-grade ECM with zero hidden fees and instant ROI:

“Dokmee cut our retrieval time by 70%—we saw ROI in 45 days.”

Chad P., CTO